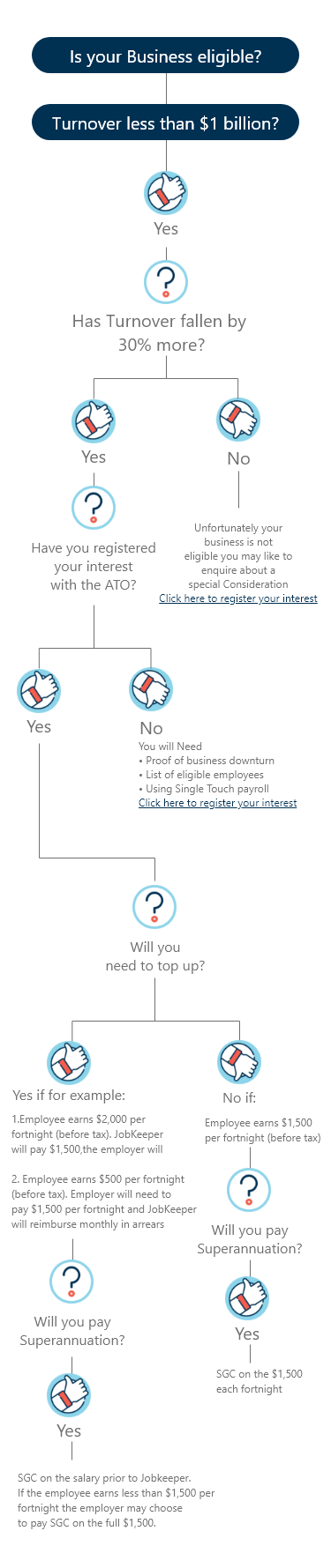

Are you eligible for the JobKeeper Package?

Please click on the icons below to complete the stimulus package quiz and find out if your business is eligible.

-

Is Your Business eligible?

-

Turnover less than $1 billion?

-

Yes

-

Has turnover fallen by 30% more?

-

Yes

-

Have you registered your interest with the ATO?

-

Yes

-

Will you need to top up?

-

Yes if for example:

1.Employee earns $2,000 per fortnight (before tax).

JobKeeper will pay $1,500, the employer will need to pay $500

2. Employee earns $500 per fortnight (before tax).

Employer will need to pay $1,500 per fortnight and JobKeeper will reimburse monthly in arrears -

No if:

Employee earns $1,500 per fortnight (before tax)

-

-

-

No

-

-

-

No

-

-

-

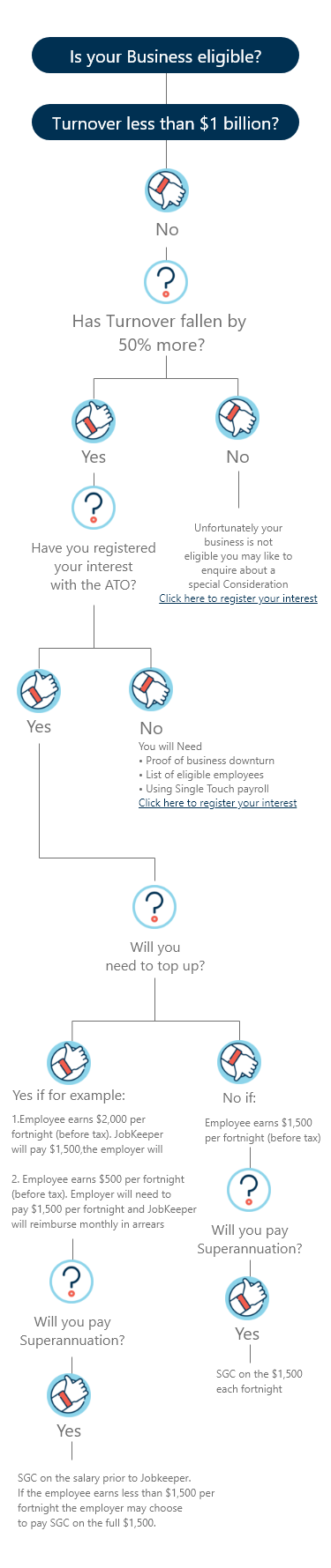

No

-

Has turnover fallen by 50% more?

-

Yes

-

Have you registered your interest with the ATO?

-

Yes

-

Will you need to top up?

-

Yes if for example:

1.Employee earns $2,000 per fortnight (before tax).

JobKeeper will pay $1,500, the employer will need to pay $500

2. Employee earns $500 per fortnight (before tax).

Employer will need to pay $1,500 per fortnight and JobKeeper will reimburse monthly in arrears -

No if:

Employee earns $1,500 per fortnight (before tax)

-

-

-

No

-

-

-

No

-

-

-

-

REMEMBER: BE ALERT FOR SCAMS!

The ATO will never ask for your personal information via SMS or over the phone. communicate via official channel (such as the ATO secure

web portal) only.

More detailed information

JobKeeper package - Click here

Managing your fair work obligations- Click here

Disclaimer: The information provided has been prepared by Modoras Accounting (QLD) Pty. Ltd. ABN 81 601 145 215. It should not be considered personal or business advice as it is intended to provide general advice only. The content has been prepared without taking into account any individual’s or business objectives, financial situations or needs. Modoras Accounting (QLD) Pty Ltd recommends that no product or financial service be acquired or disposed of or business strategy adopted without you first obtaining professional advice suitable and appropriate to your own business needs, objectives, goals and circumstances. While the information provided is believed to be accurate, to the extent permissible by Law, neither Modoras Accounting (QLD) Pty Ltd nor its employees, representatives or agents (including affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this material. Liability limited by a scheme approved under Professional Standards Legislation.

Brisbane

(07) 3219 2555

Level 3, 50-56 Sanders St

PO Box 6530

Upper Mt Gravatt QLD 4122

Gold Coast

(07) 5570 6150

Suite 38, Level 4, 46 Cavill Ave

PO Box 2322

Surfers Paradise QLD 4217

Newmarket

(07) 3856 6300

8 Edmondstone Street

PO Box 3080

Newmarket QLD 4051

Sydney

(02) 9923 2499

Level 2, Suite 201,

157 Walker Street

North Sydney, NSW 2060

Melbourne

(03) 9391 8332

39 Cabot Drive

PO Box 627

Altona North VIC 3025

IMPORTANT INFORMATION: This blog has been prepared by Modoras Accounting (QLD) Pty Ltd ABN 81 601 145 215. The information and opinions contained in this blog is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals' personal circumstances have been taken into consideration for the preparation of this material. The information and opinions herein do not constitute any recommendation to purchase, sell or hold any particular financial product. Modoras Accounting (QLD) Pty. Ltd. recommends that no financial product or financial service be acquired or disposed of or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog can change without notice. Modoras Accounting (QLD) Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Accounting (QLD) Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Accounting (QLD) Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication. Liability limited by a scheme approved under Professional Standards Legislation.